Looking In the Reflection of Your Data...

A case for ditching third-party data for decision making

Death by Survey

I once worked at a company that emailed out two or three surveys per week. Without fail. It baffled me that every department’s tool to detect deficiencies, discern sentiment, or drive culture was a survey. The plethora of reminders that followed further aggravated the tedium. The road to survey fatigue was inevitable.

While I appreciate a good take-down, I’m not here to diss surveys and run. I dislike sending them even more than receiving them. Logistics make them expensive, time-consuming and distorted by incentives. Once I saw a survey respondent haggle for a bigger incentive, that was it for me - no mas!

The (Data) Truth Hurts

There is a place for surveys aka third-party data, however, as is inevitable with every marketing tool, the more you use it, the less effective it is. There’s a better way.

We comfortably discuss third-party data but never seem to ask why first- and second- party data are never actually at the party. Probably because first- and second- party data, which are internal to your business, are almost too truthful, and show us what we would rather not see.

While third-party data tells you what your customers want, internal data reveals what you need to change. The customers didn’t do what you expected but…it’s not them, it’s you. If you underutilize first-party data, expect to be the one stunned when the break up conversation with your customer comes.

First-party data is yours. You collect directly from your customers through your own channels. For example, your website, their purchase history, etc. It's accurate, privacy-compliant, very relevant to your business, and cannot be replicated by your competition. Therefore, since your data is well protected within your infrastructure, it becomes a source of your competitive advantage.

First-party data is both your greatest secret and your loudest truth.

By the way, sharing your data does not automatically translate to giving away your competitive advantage, as the recipient shouldn’t be equipped to draw the same insights from it that you would for your business. Your competitor cannot personalize services for their customers with your data, for instance.

Second-party data is data shared with you by another company that you’re in a partnership with. Either partner is collecting the data and does not demand a fee for sharing it. Companies can form partnerships with non-competing businesses to share data, which can enrich their understanding of customer behavior without the broad, less accurate nature of third-party data. For example, a retailer inevitably shares data with its point-of-sale hardware provider. Second-party data is often underutilized but can take the guesswork out of making strategic decisions.

Building on our example, the POS provider could share transaction-level data, including details on how customers are paying, what times of day are busiest, and the average transaction size. This could then be combined with first-party data such as individual customer purchase history, online shopping behaviors, like abandoned carts or frequently viewed items to optimize store layouts and understand cross-channel behavior. If the combined data reveals that customers who purchase premium products often shop during off-peak hours and prefer quick, efficient transactions, the retailer might create express checkout lanes specifically designed for these high-value customers.

Third-party data is data collected by an external entity that's not directly connected with the consumer, and is typically purchased from a data aggregator or broker. My unsubstantiated opinion is that the efficacy of third-party data is in decline because of problematic data quality, and as privacy fears are stoked, increasing privacy regulations and the phasing out of third-party cookies will continue to make things worse.

Don’t Just Collect It—Connect It

All internal data is potentially valuable, even the data that looks like a by-product, your favorite unicorns and I know this to be true.

The battle for a competitive advantage has moved from the source of the data, to what is done with the data.

I have mourned the missed opportunities of companies that collect tons of data only to let it sit idle. I get it, analytics is hard but losing market leadership is harder.

The point of having experienced hands in a business is their foresight - this foresight can be baked into how data is analyzed in an organization. Greylock calls this a “System of Intelligence” - which is basically a systemized approach to using and analyzing available data in a business. Internal data, combined with external, in real time and experiences becomes a powerful decision-making engine that can be routinely and automatically used. It enables rapid decision-making and crushes indecision, drawing insights from every corner of the business—whether from employees, infrastructure, or customers. This capability transforms internal data into a formidable moat, protecting and propelling the business in an increasingly competitive landscape.

The difference between market leadership and obsolescence lies not just in having data, but in acting on it. It's not just about having the data - it's about transforming it into actionable intelligence that drives strategic decisions and operational excellence:

Cultural Design / Transformation: An organization (re)shaped to make decisions with first-party data, creates a fantastic baseline for a new organization or even a catalyst for an older organization to change its culture. When everyone examines every customer interaction for its data-generating potential, it triggers a natural focus on continuous improvement and personal accountability to the data and KPIs based on that data. Further, when internal data is available across teams, the silos that inevitably form as an organization grows. The outcome is that business agility baked into the culture in the long-term, when done right.

Operational Insights: First-party data, delivers precise and deeply relevant visibility into operations, in a way that no external data source can. Many dashboards I’ve seen are built to track outcomes e.g. revenue, uptime, but the great ones at would-be unicorns track drivers of these outcomes just as rigorously.

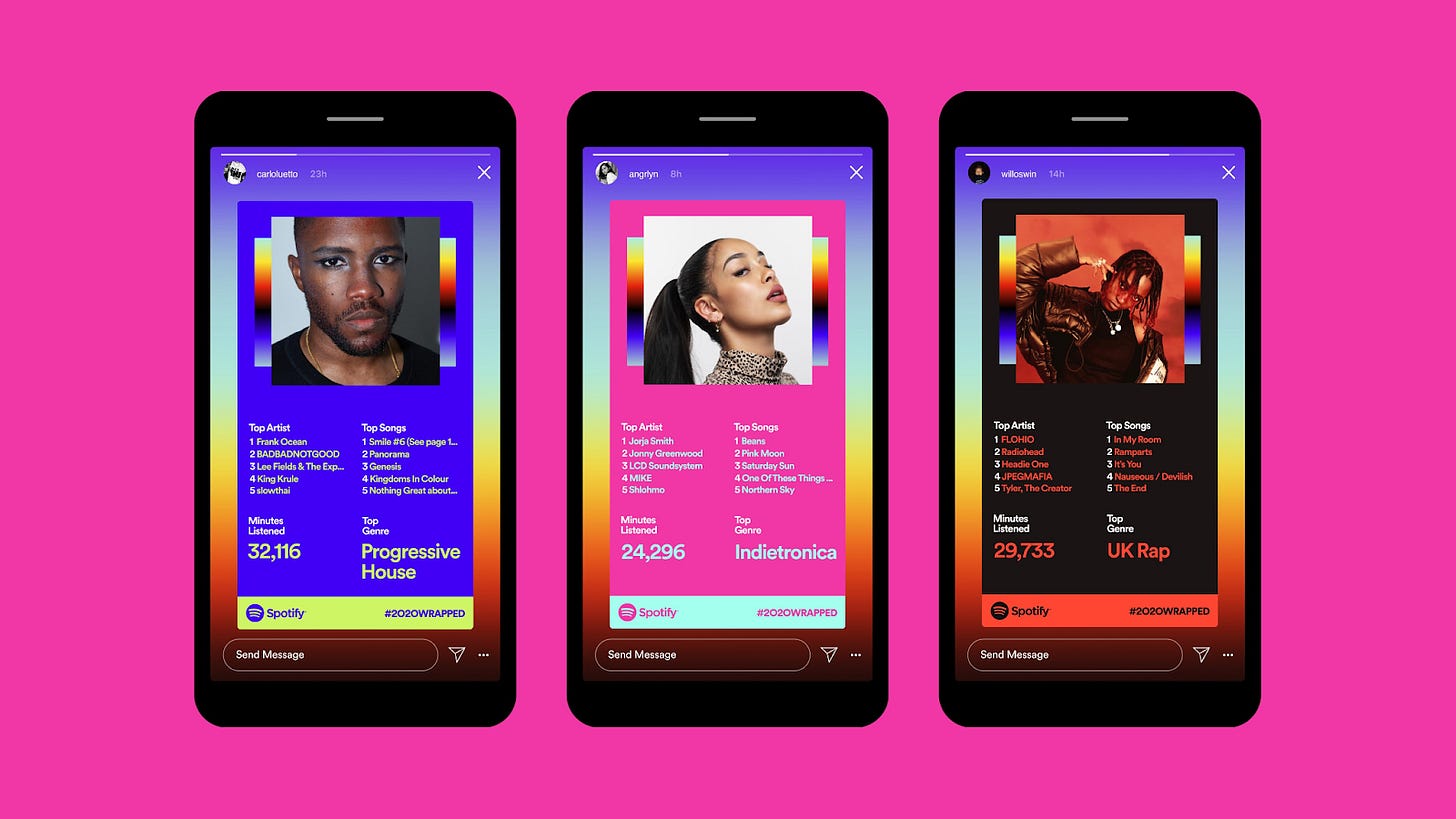

There would be no Spotify Wrapped if Spotify did not track and analyze every click. But tracking every click is not enough, the insight from each click is just as important. Of the two images below, one tracks outcomes - total listens, top tracks etc. The other image tracks drivers (milestones, in this case) - ‘date of first stream’, ‘100th stream’, alongside totals. This means that their logs are designed to track each experience independently, not just an aggregate so that they understand how the events aggregate - a much deeper insight.

This campaign has raised Spotify’s brand love significantly and though everyone has tried, - nobody has created the same magic, in part because they neither generate nor analyze their data exactly like Spotify - because their systems of intelligence are not the same.

To take things up a notch with a deeper focus on driver-based analysis, Spotify could mark you “Streaming Anniversary” of your favorite song, or your “Female Hip Hop Artist Appreciation” journey to showcase how your music taste evolves over time.

Fun fact: Spotify is best known for it, but wasn't even the first app to do a ‘Wrapped’ feature, Strava was.

Predictive Innovation: Another great thing internal data supports is innovating on the cheap. Your internal data is ready and waiting, eager to guide you but mostly ignored. Internal data allows you to innovate frugally and predictively - this is especially critical in emerging markets, where resources are often constrained and the margin for error is slim. Netflix's "House of Cards," is a landmark example of data-driven innovation.

Some have called it a $100 million dollar gamble, but it was not. Netflix didn't just randomly decide to remake a British political drama. They analyzed their vast trove of user viewing data, identifying a significant overlap between fans of political dramas, viewers of Kevin Spacey films, and admirers of the director David Fincher. This intersection of preferences indicated a high probability of success for a political drama starring Spacey and directed by Fincher. By taking a show concept with a proven audience and tailoring it to their specific user base, Netflix minimized risk while maximizing potential return on their substantial investment. Pity Mr Spacey ruined it later…

By deeply analyzing internal data, companies can identify unmet needs, predict market trends, and develop products or services that precisely match local preferences and constraints. For instance, a mobile payment provider in a developing country might analyze transaction patterns to identify the need for offline payment solutions in areas with unreliable internet connectivity. Or a consumer goods company might use sales data to predict seasonal demand fluctuations, allowing for more efficient inventory management and reduced waste. In each case, the key is not just having the data, but asking the right questions and applying the insights in ways that drive meaningful innovation and business growth.

Eliminating Waste: We already know how much I love hate surveys. They’re well-intentioned, but the customer and team fatigue they create will always force me to reconsider using surveys if I have a choice.

With first-party data, companies can gain deep insights into product usage patterns, employee satisfaction levels, and customer retention trends without the need for constant external feedback loops. Continuous surveying often falls into the $10 task category - low-value activities that consume disproportionate amounts of time and energy.

Instead of bombarding users with satisfaction surveys in a fintech app, the company can analyze transaction frequencies, feature usage patterns, and customer support interactions to gauge user engagement and identify pain points. Similarly, employee satisfaction can be inferred from productivity metrics, system usage patterns, and internal communication dynamics.

This shift from asking to observing not only reduces organizational overhead but also provides more authentic, real-time insights into the pulse of the business. This approach allows companies to respond swiftly to changing conditions without the lag time associated with traditional feedback mechanisms. By embracing this mindset, organizations can redirect their energy from data collection to data analysis and action, fostering a culture of continuous improvement and innovation rooted in the wealth of information they already possess.

From Touch Points to Turning Points

Surveys used to be the only touch point but now every touchpoint is data, every interaction fountain of insight, every click a clue.

To activate first-party data in your organization, start by setting your objectives, find your touchpoints, collect the data, analyze the findings, and then implement the insights. The key is to identify your touchpoints, which could be digital (websites, mobile apps, chat bot interactions, email campaigns), physical (in-store visits, service calls, events), or hybrid (QR codes in physical stores linking to online content, in-store pickup of online orders, virtual product demonstrations).

Each touchpoint is more than just an interaction - it’s an opportunity for your customer to say volumes without saying a word. For example, website visits can provide information on user behavior, preferences, and intent. In-store visits can offer insights into product popularity, peak shopping times, and customer demographics. Social media interactions can reveal sentiment and engagement levels. The key is to approach each touchpoint with a data-collection mindset, asking yourself: What can we learn here? What data can we ethically and legally collect that will help us better serve our customers and improve our business?

Start with the most impactful touchpoints for your business and gradually expand data collection and integration efforts. prioritize the data sources that align most closely with your critical business questions and strategic objectives. As you build capacity and demonstrate value, you can expand to more comprehensive data extraction and analysis processes.

Your internal data, when properly harnessed, can be your most powerful tool for driving innovation, enabling business agility, and sustained growth.

****

If you like this article, you may also want to check out:

Thank you so much Adia.

I’m a content/community manager and this just gave me insight into how to do more with not just data from my channels but also with data from all Cx and the technical teams.

Thank you so much Adia. I’ve been thinking a lot about this regarding Brand and Comms. Measuring things like brand love, TOMA scores, message pull through rate, and even data storytelling for the business.